Posted on: September 1, 2022, 05:11 am.

Last updated on: September 1, 2022, 08:12h.

Even distribution of slot machines and table games across the various integrated resorts operated by Macau concessionaires could be problematic for Sands China, according to Morgan Stanley analysts.

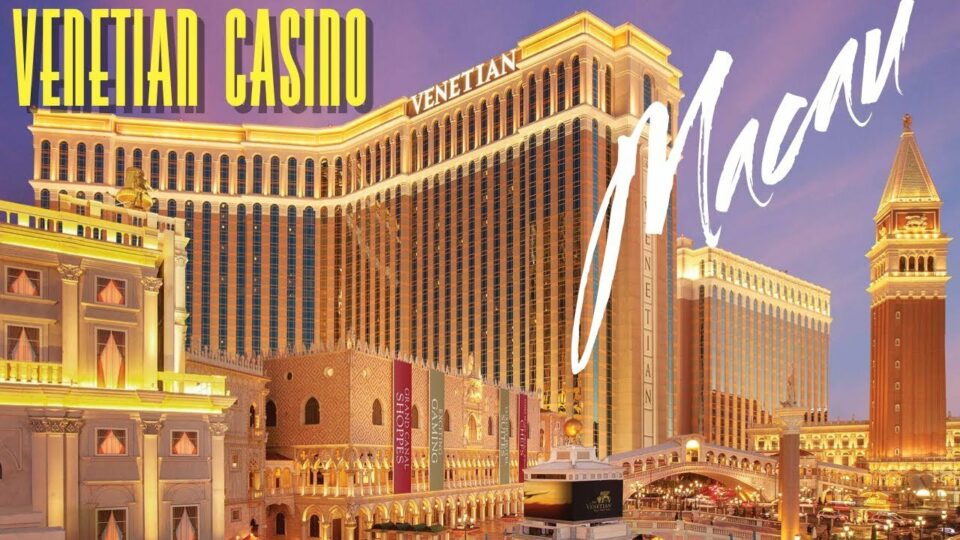

The Venetian Macau. Morgan Stanley says operator Sands China could be vulnerable to efforts to evenly distribute slots and table games. (Image: YouTube)

Under the special administrative region’s (SAR) new gaming laws, regulators limit slots to 12,000 devices across Macau casinos and 6,000 table games. While those figures are in line with the levels seen at the end of the second quarter, they’re markedly below those seen before the coronavirus pandemic. In 2019, there were more than 17,000 gaming machines at Macau gaming venues and 6,739 table games.

While Macau operators appear comfortable with annual revenue requirements of about $866,000 per table and $37,100 per machine (all figures in US dollars), the specter of regulators potentially mandating even distribution of slots and table games could be onerous for some concessionaires, including Sands China — the largest operator in the SAR.

Should Macau regulators proceed with the even distribution gambit, each concessionaire would be entitled to 1,000 tables and 2,000 gaming machines. That’s potentially worrisome for an operator of Sands China’s heft because it runs five integrated resorts in the SAR.

Not All Bad News for Sands China

While the gaming device/table limit is undoubtedly concerning for Sands China, Morgan Stanley notes the plan is ambitious for a simple reason: Some smaller operators don’t have the square footage to accommodate more gaming amenities.

The bank mentioned MGM China, which runs two Macau venues, as a prime example of a concessionaire that doesn’t have the room to add more slots and tables.

In theory, if the plan moves forward, Sands China and SJM Holdings would be losers in table games. That’s while the Venetian Macau operator, Galaxy Entertainment and Melco Resorts & Entertainment would all lose slots, according to Morgan Stanley.

On the flip side, MGM China — if it can accommodate the new additions — and Wynn Macau would add table games, while MGM, SJM, and Wynn would each add slots, the Bank added.

Macao Could Hold Off on Distribution Plan

Capping the number of machines and tables available to guests is one thing. But ensuring equal distribution across venues is another matter that Macau regulators may not want to embark upon as the SAR’s gaming industry continues struggling with the effects of the coronavirus pandemic.

Earlier today, the Gaming Inspection and Coordination Bureau said August gross gaming revenue (GGR) was $270.8 million, or just half the August 2019 level. Analysts measure fresh Macau revenue data against 2019 comparables because that was the last year before the COVID-19 crisis.

Additionally, regulators may be loath to fiddle with Sands China’s business model, which is largely driven by mass and premium mass players — an important point when some analysts believe the Asia-Pacific VIP gaming market is years away from recovering.